Law Firms which have adopted FAST Payment for Stamp Duty. The system was launched in 2009-10.

Regulation 4 and Schedule 1 of the STAMP DUTY E-STAMPING OF INSTRUMENTS AND SELF-ASSESSMENT REGULATIONS 2012 SI.

. Stamp duty is a tax that is levied on single property purchases or documents including historically the majority of legal documents such as cheques receipts military commissions marriage licences and land transactionsA physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document. ASMEs banking information can be found on the invoice. For Property Go to next level.

Electronic Tax Reserve Certificates Scheme - Application Form. Basically stamp duty in Maharashtra State is charged on the type of instruments listed in Maharashtra Stamp Act of Schedule I. Integrated Queue Management SystemIQMS is operational in 27 Registration Offices.

Late Payment of Stamp Duty. Stamp Duty Management - Notice of Assessment. 1 st April 2021.

E-Payment is compulsory if Stamp Duty payable is more than Rs10000- or Registration Fee payable is more than Rs5000- or both. Request for Letter of Confirmation of Payment. Refer to the Section 67 Document Guide PDF 120KB or contact RevenueSA for advice on this.

For Property Go to next level. The registration fee payable for the old law system is typically TT10000 and TT5000 for the RPA. Printing of e-Assessment Slip.

Stamp Duty Go to next level. Profits Tax Computation. If the exemption or relief is general then the instrument is not liable to duty under any head of charge in Schedule 1.

View and download Stamp Certificates issued by IRAS. If two or more documents arise from a single contract of sale or together form or arise from substantially one transaction or one series of transactions Section 67 of the Stamp Duties Act 1923 may result in duty being assessed on the total transaction considerationvalue. A share certificate is a certificate given to the equity shareholder of the company in the form SH-1.

The transactions take place through a web-portal named as Government Receipt Accounting System or GRAS. Stamp duty in Maharashtra is 5 in Uraban and 4 in Rural wef. ONLINE PAYMENT OF STAMP DUTY ON SHARE CERTIFICATES.

Firstly Stamp duty on share certificate. Maharashtra State Government introduce e-payment mode of payment in addition to the conventional methods of making payment of various taxes through online payment system. Deed of Residential Mortgage This deed is used in the purchase andor construction of a residential property.

If you are identified by our Compliance Services Branch for not paying or underpaying stamp duty you will be issued an assessment for the stamp duty liability that you need to pay. The rates of duty vary according to the nature of the instruments and transacted values. In this topic we have taken stamp duty in Maharashtra State for our users to know more about stamp duty on immovable property.

Advance Ruling System for GST. 10 - 20 minutes. Share certificate being an instrument requires stamping.

Stamp duty on share certificate is a state-related matter where delay in payment of stamp duty appeals penalty. For system requirements of using the Form please refer to the link below. For stamp duty payment modes please refer to How to Pay Stamp Duty.

How to Object to Stamp Duty Assessment. All payment methods should contain Account Number Application Number and Invoice Number to ensure prompt processing of payment. Inland Revenue Authority of Singapore.

Under these circumstances payment cannot be made at a Service SA Customer Centre and must be paid direct to RevenueSA using the payment details supplied on the assessment notice. Assessment and payment of stamp duty can be made electronically via the Inland Revenues Stamp Assessment and Payment System STAMPS system. When to Pay Stamp Duty.

Advance Ruling System for GST. Exemptions and reliefs from stamp duty may be either general or specific. Stamp Duty Go to next level.

Notice of Objection Application for Revision of Assessment.

Mechanical Engineering Lab Equipments Civil Engineering Lab Equipments Certificate Templates Mechanical Engineering Engineering

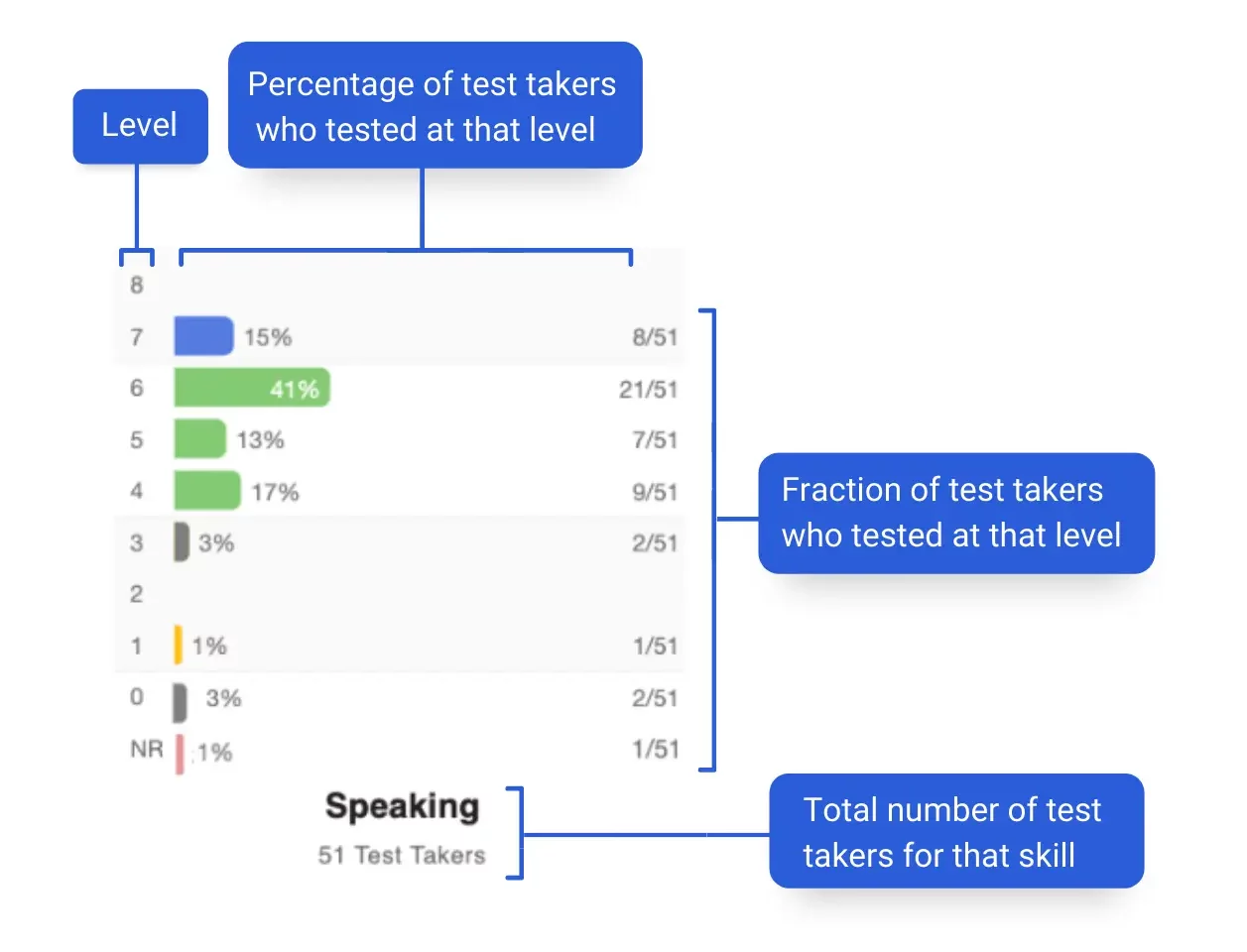

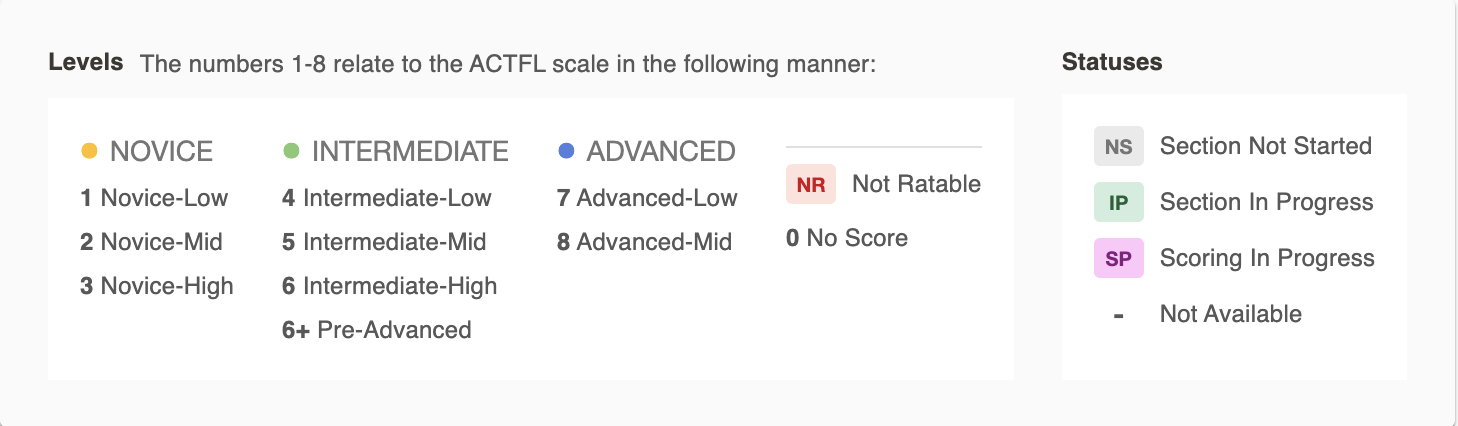

Stamp 4s Reporting Guide Avant Assessment

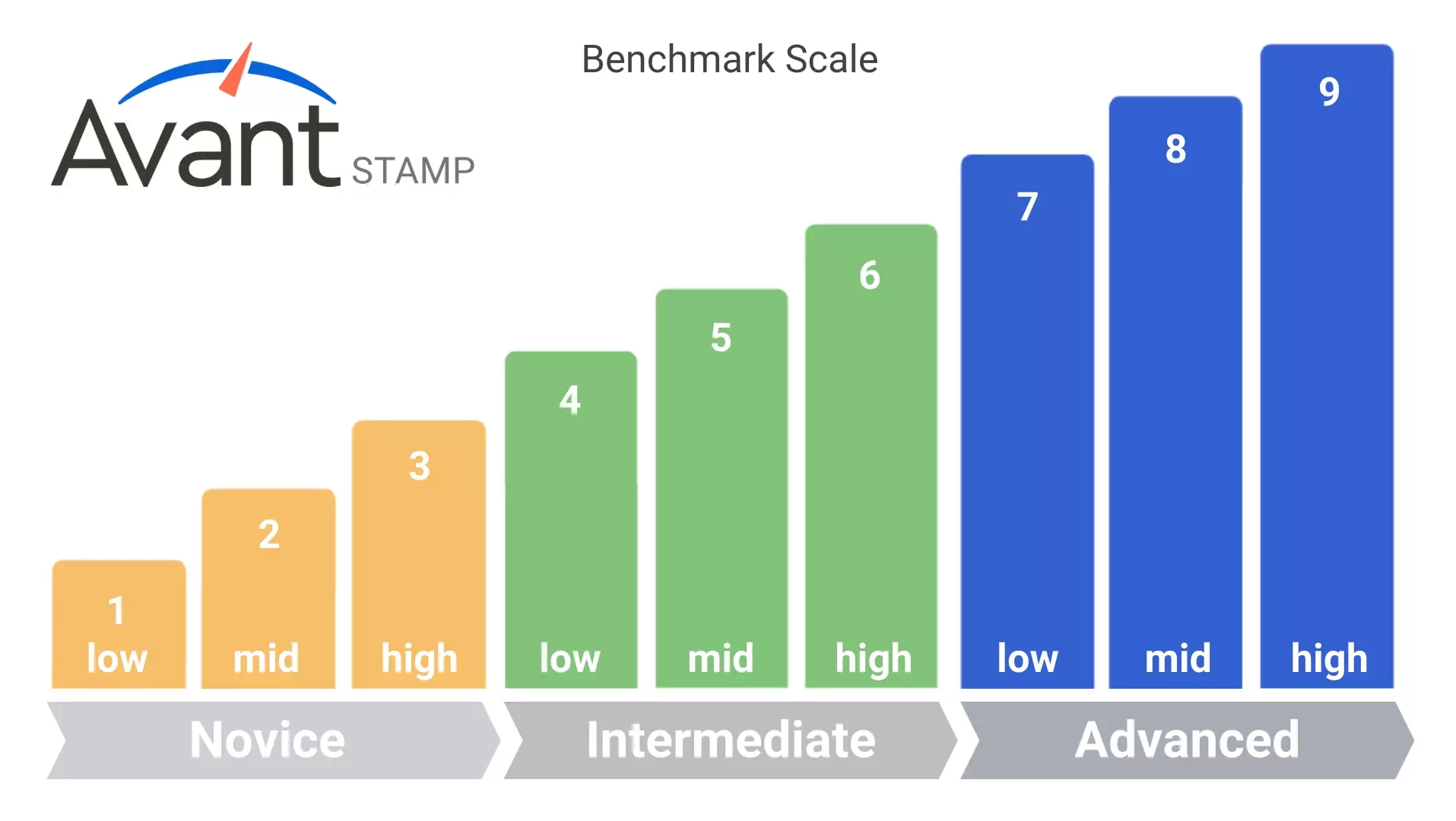

Stamp Scaled Scores Avant Assessment

Stack Of Old Books Postage Stamp Wedding Postage Stamps Wedding Invitation Postage Stamps Wedding Postage

Cute Stork Baby Neutral Baby Shower Postage Zazzle Com Wedding Invitation Postage Stamps Wedding Postage Stamps Invitation Postage

Easy Anecdotal Note Taking Use A Clipboard And A Page Of Address Labels Stamp With A Date Stamper An Anecdotal Notes Classroom Assessment Teacher Organization

Uncle Sam Fourth Of July Stamp Wedding Postage Stamps Wedding Invitation Postage Stamps Wedding Postage

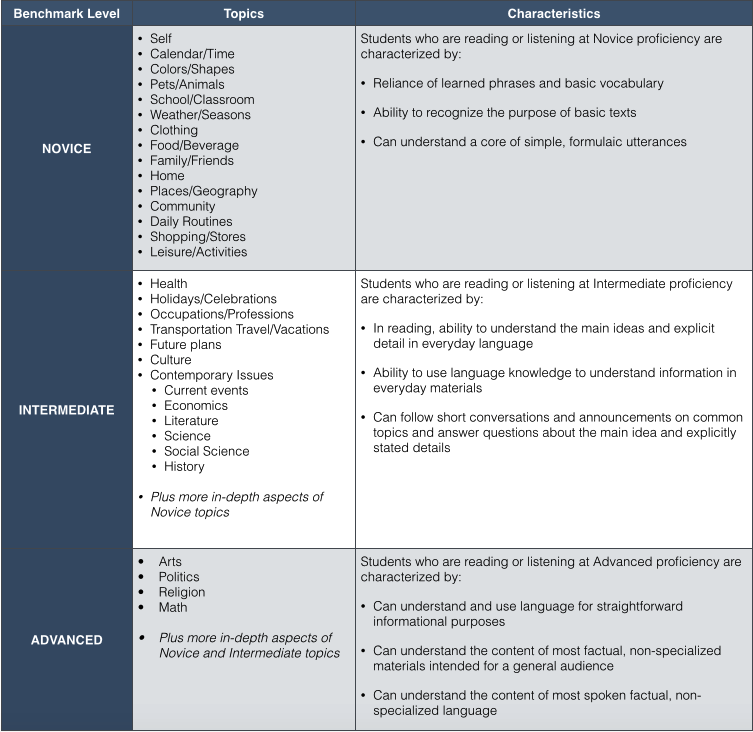

Stamp Benchmarks Rubric Guide Avant Assessment

Stamp Placement Testing Center

Stamp Screening Tool For The Assessment Of Malnutrition In Paediatrics

Stamp Benchmarks Rubric Guide Avant Assessment

Jesus Built My Hot Rod Art Collage Stamp

Family Fecs Montessori Activity Stamp Game Dynamic Addition Montessori Activities Montessori Fraction Activities

Teachersgram In 2022 Success Criteria Assessment Tools Stamp

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

Stamp Benchmarks Rubric Guide Avant Assessment

Stamp Benchmarks Rubric Guide Avant Assessment

Pin On American Flag Postage Stamps

Www Stampshopcentral Com Effective Resume Resume Examples Good Essay